The Pay Type module allows HR managers to define and manage different types of employee compensation structures. This ensures payroll accuracy, compliance with labor laws, and flexibility in managing various forms of earnings and deductions. It categorizes employees’ pay into specific types to ensure transparency in payroll processing.

Core Functionalities:

- Pay Type Selection – HR managers can choose from multiple pay types based on employment contracts and company policies.

- Customizable Pay Structures – Allows organizations to configure pay types according to job roles, seniority levels, and employment status.

- Automated Calculations – Ensures accurate payroll processing by automatically applying pay rules, deductions, and bonuses based on predefined pay rates.

Types of Pay Structures:

- Wages – Compensation based on hourly rates, daily earnings, or piece-rate work. Typically used for temporary, part-time, or contract workers.

- Compensation – Fixed salaries, commissions, and bonuses provided to employees.

Includes:

- Salaries – Fixed monthly payments for full-time employees.

- Bonuses – Performance-based incentives or annual bonuses.

3. Deductions – Amounts subtracted from employee earnings, including:

- Taxes – Payroll tax deductions as per government regulations.

- Benefits Contributions – Deductions for health insurance, retirement plans, and social security.

- Loan Repayments – Salary deductions for employee loans or advances.

- Garnishments – Court-ordered deductions for legal obligations

Compliance & Reporting – Ensures payroll adheres to labor laws, tax regulations, and organizational policies while generating reports for audits and financial management.

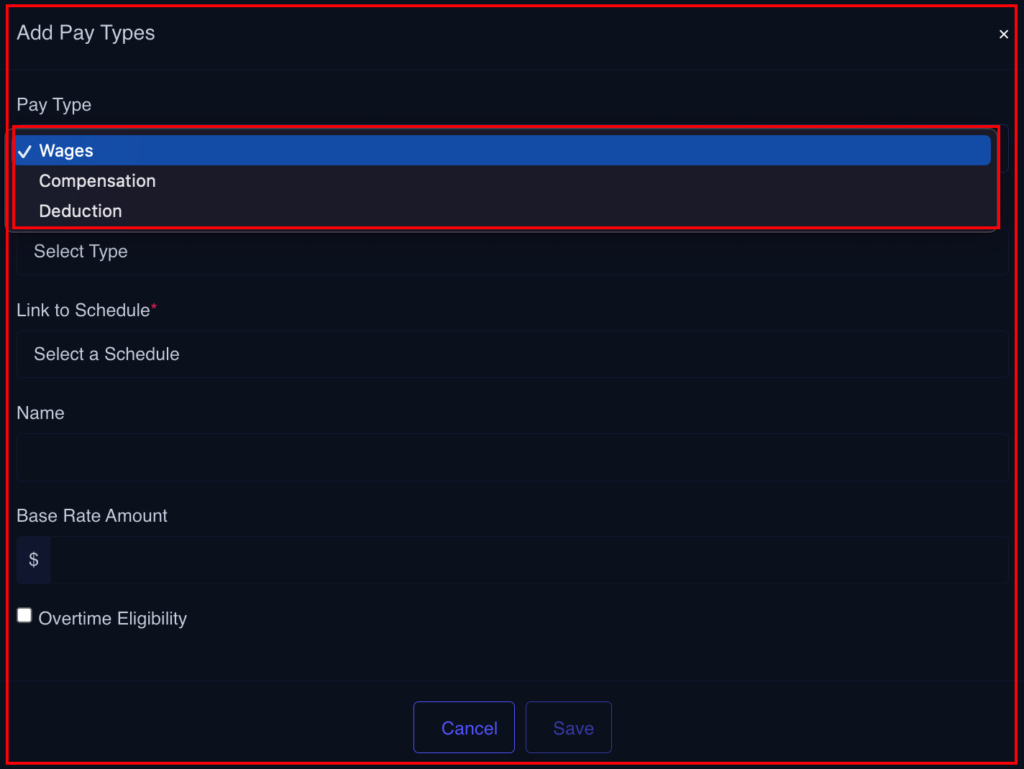

Creating Payroll Types

- Click the Add Pay Types button

- Select the desired Pay Type

- Enter requires information