The Pay Plan module provides HR managers with a structured framework to define and manage employee payroll structures. It enables the creation of customized pay plans tailored to different employee categories, ensuring accuracy in wage distribution, tax compliance, and benefit deductions.

Core Functionalities

- Adding Wages

HR managers can configure wages for employees based on hourly, daily, or piece-rate work structures.

- Fixed Hourly/Daily Wages – Set up standardized wage rates for part-time and full-time employees.

- Piece-Rate Pay – Assign wages based on the quantity of work completed.

- Overtime Pay Rules – Define additional pay rates for overtime hours.

2. Adding Compensation

This allows organizations to structure additional earnings beyond base wages.

- Base Salary – Assign fixed salaries to employees on a monthly or annual basis.

- Bonuses & Incentives – Configure performance-based bonuses, holiday bonuses, and retention incentives.

- Commission Plans – Set commission percentages for sales and business development roles.

3. Adding Deductions

HR managers can create automated deductions to ensure accurate payroll calculations.

- Benefits Deductions – Employee contributions for health insurance, pension funds, and retirement plans.

- Loan Repayments – Salary deductions for employee loans or salary advances.

- Garnishments – Legal deductions such as child support or court-ordered wage garnishments.

4. Adding Taxes

This functionality ensures payroll tax compliance with local labor laws and regulations.

- Income Tax Withholding – Deduct income tax based on employee salary brackets.

- Social Security Contributions – Automate deductions for government-mandated contributions.

- Other Payroll Taxes – Configure additional tax obligations such as Medicare, unemployment insurance, or regional taxes.

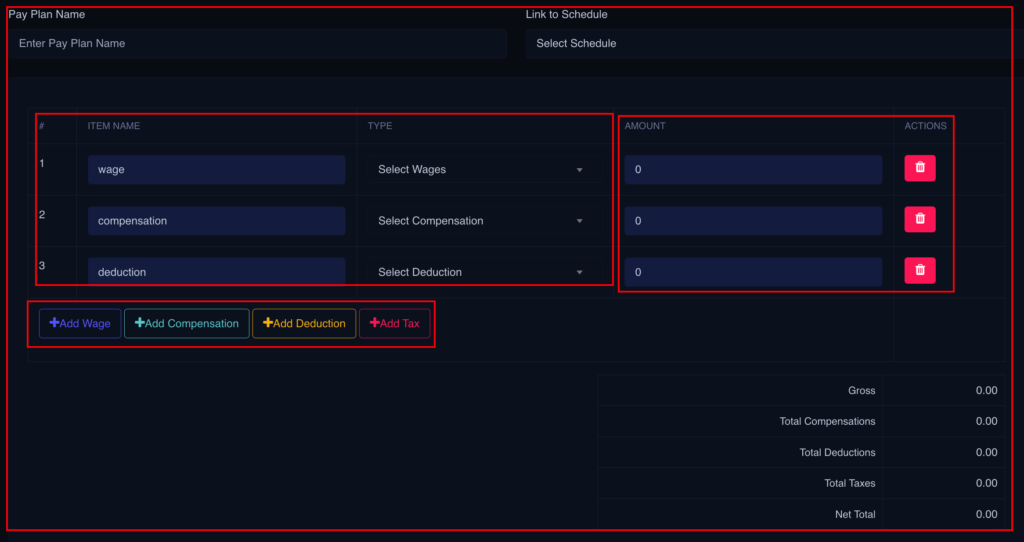

Creating Pay Plans

- Click the Add Pay Plan

- Add different Pay Plan categories as shown

- Select or add required data where applicable